What Does a Home Warranty Cover?

Let’s say you’ve found a crack in your foundation or water in your basement. Neither of these are good things, and sometimes they’re expensive repairs. Since it’s your home- a major investment and your shelter from the world- fixing it is non-negotiable. But there’s a possibility you may not be liable for the full cost of the repairs if you have a home warranty.

Acculevel specializes in repairing foundations and waterproofing basements & crawl spaces since 1996. We are often asked if needed repairs are covered by any warranties, so we’ve researched the options and compiled the information for you. Our goal is to help homeowners in difficult situations understand their home warranties and obtain the maximum benefit of these policies.

New Construction: Implied Warranties

Warranty terms for new construction vary from state to state. One thing they all agree on is that an implied warranty comes with a newly-built home; this ‘implication’ is that the home will be sound and habitable.

An implied warranty generally offers limited coverage for both the workmanship and the materials used in the new construction. The length of the warranty can vary, but any issues with the foundation or structural stability should be covered by the warranty during the coverage period.

But a limited warranty means that the builder is not liable for all issues that may arise- your appliances, for example. That would be covered by their manufacturer’s warranty instead of the builder’s. This means that if your sump pump fails and the basement floods, the sump pump is the responsibility of the manufacturer to repair or replace.

Any water damage is going to come out of your pocket unless you have an insurance policy that covers this. And indirect costs are rarely covered; if you choose to stay in a hotel while repairs are made in the home, this would also come out of your own pocket.

Also, many warranties define the home as the inhabited dwelling only. You should watch for statements like “appurtenant components are excluded.” This is an elaborate way of saying anything not directly connected to the house is not covered: these are items like a patio, driveway, detached garage, fencing, etc.

New Construction: Implied vs. Express Warranties

Many new home builders choose to offer express warranties that supersede (or replace) the implied warranty. This is an agreement negotiable between the builder and the buyer, and it does require the buyer’s consent to waive the implied warranty provisions.

Express warranties do not necessarily cover more than implied warranties; in fact, they may cover less. The purpose of an express warranty is to clearly document the builder’s responsibilities. Implied warranties rely on interpretation, often by a court of law, and that variable is outside the control of both builder and homeowner. (An example of that variable is Ohio, notes below.)

Some states place restrictions on express warranties, and we have reviewed the terms for those in our service range. If you live outside of our service area, we recommend contacting the appropriate state’s building association.

In Indiana, the express warranty must include:

- For the first two years, the home is free of defects caused by faulty workmanship or defective materials.

- For the first 10 years, the home will be free of major structural defects.

In Illinois, Kentucky, and Michigan: express warranties are permitted, but no restrictions currently exist.

In Ohio: there are no specific requirements for express warranties, but their Supreme Court has ruled that “A home builder’s duty to construct a house in a workmanlike manner using ordinary care is a duty imposed by law, and a home buyer’s right to enforce that duty cannot be waived.” In short, signing an express warranty in Ohio does not negate the implied warranty- even if that is its intention.

Third Party Warranties

Depending on the state you live in, and the type of financing you have, there may be more regulations or laws involved. The most common requirement is for the builder to provide a third party warranty to protect the buyer. Both the Federal Housing Authority (FHA) and Department of Veterans’ Affairs (VA) require this if the newly built homes use FHA or VA loans.

Third party warranties are often involved in real estate transactions with existing (opposed to newly constructed) homes. This is usually a short term warranty purchased to cover any unexpected issues that occur after the transaction is complete.

There are a number of companies that provide these types of warranties, and as you would expect, they come with a range of coverages and options. Some of them specialize in new construction, while others will cover existing homes.

We spoke with general manager Lane Clegg at Residential Warranty Services to learn more about the options available to existing homes. At RWS, there are no restrictions on the age of the home. They have a real estate-specific warranty option that is valid for 90 days after the home inspection is complete OR 22 days after closing (whichever date is later).

They also provide options for homeowners who want to supplement their insurance plans with warranty coverage. If you choose to purchase such a warranty, there are a range of plans that include foundation cracks, appliances, and other items that may not be covered -or not fully covered- by your insurance policy.

If you have questions about home insurance, and what types of repairs it will cover, we have a companion article that explores those options, also.

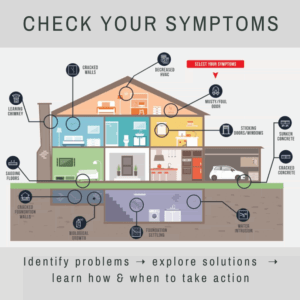

Do you have questions about a repair issue in your home? We have a free tool that homeowners can use to evaluate symptoms and provide solutions.

Do You Need Foundation Repairs or Waterproofing?

If so, you should find an experienced specialty company, and make an appointment. Before you sign a contract for any service, always verify the company is reputable, insured, and accredited by the Better Business Bureau.

If you live in Indiana or the surrounding states, contact Acculevel. Established in 1996, we specialize in foundation repairs and waterproofing basements and crawl spaces. If you have noticed any problems and would like an evaluation, you can request a free estimate. An experienced project manager will examine the areas of concern and recommend the best course of action for you, to keep your home strong and healthy for years to come.